Strongest participation from marquee investors

Mumbai, September 30, 2025 – Suba Hotels Limited, a fast-emerging name in India’s mid-market hospitality industry, has achieved a significant milestone ahead of its Initial Public Offering (IPO). The company raised ₹21.29 crore by fully subscribing its Anchor Investor Book at the upper price band of ₹111 per equity share, marking a historic moment in the SME IPO space.

Strong Backing from Market Veterans

The anchor round saw enthusiastic participation from some of India’s most celebrated investors. Ashish Kacholia (through Bengal Finance & Investment Pvt. Ltd.), Mukul Agrawal, and Sunil Singhania (via Bharat Venture Opportunities Fund) led the investment, joined by Capri Global and other respected institutions.

For a hospitality chain operating in the SME IPO segment, attracting such marquee names is rare. Their participation not only validates Suba Hotels’ business fundamentals but also underscores strong belief in its growth strategy and future profitability.

Why Investors Are Betting on Suba Hotels

Founded with a vision to bridge the gap between affordability and quality, Suba Hotels has grown steadily across India’s business and leisure hubs. The company follows an asset-light model, focusing on management and franchising rather than heavy capital investments in real estate.

This approach allows Suba Hotels to:

- Expand rapidly across multiple cities without incurring high debt.

- Reduce operational risks while improving margins.

- Leverage brand consistency across properties to attract both business and leisure travelers.

- What these numbers indicate Investor confidence remains high in Suba Hotels’ mid-market positioning, reflected in the broad demand from NIIs, FIIs ex-anchor, and retail participants.

- The strong NIIs and FIIs participation points to a belief in Suba Hotels’ growth potential across its 88-hotel portfolio in 50 cities, with emphasis on tier 2 and tier 3 markets.

- Market positioning and outlook Suba Hotels is positioning itself in India’s expanding mid-market travel demand, particularly in tier 2 and tier 3 cities. The robust Day 3 response supports a favorable aftermarket scenario if price discovery aligns with investor demand.

- Company profile and growth backdrop Suba Hotels Limited operates a predominantly mid-market hotel chain with 88 hotels and 4,096 keys. The portfolio comprises five owned hotels, 19 managed hotels, 14 revenue-share and lease hotels, and 48 franchised hotels.

- The expansion trajectory remains vigorous, with 40 hotels in the pre-opening phase adding 1,831 rooms to the pipeline.

A Rare Achievement in the SME IPO Market

Industry experts note that it is uncommon to see multiple marquee investors come together in a single anchor round for an SME IPO. Such participation is generally reserved for larger mainboard IPOs. This makes Suba Hotels’ anchor round a standout case, signaling strong institutional trust.

Market analysts suggest that this development could enhance the IPO’s visibility, attract retail investors, and potentially lead to an oversubscribed issue when the public offering closes.

Anchor Investor Allocation Details

- IPO Price Band: ₹111 per equity share

- Total Anchor Shares Allotted: 19,17,600

- Total Funds Raised: ₹21.29 crore

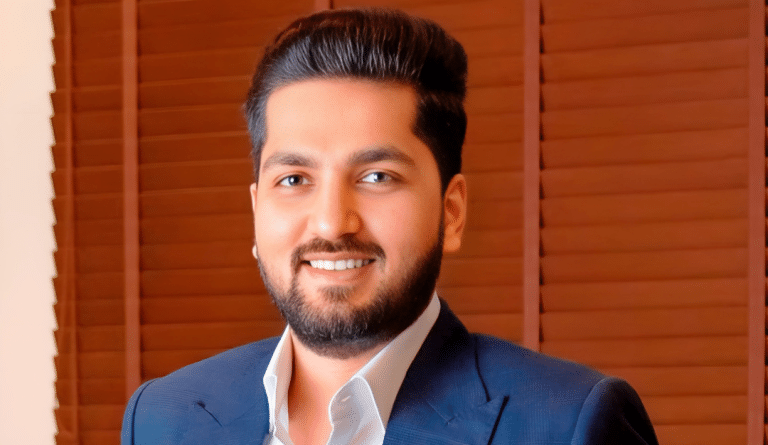

Suba Hotels’ Vision and Leadership

Under the leadership of Mubeen Mehta, Chief Executive Officer, Suba Hotels has been steadily building a reputation for offering value-driven hospitality with modern amenities. The company’s portfolio spans business destinations, tier-2 cities, and popular leisure locations, aligning with India’s growing travel and tourism sector.

Speaking on the achievement, industry observers believe the strong anchor investor turnout will boost confidence among retail and institutional investors as the IPO progresses.

Outlook

With its anchor book already making headlines, Suba Hotels is well-positioned to capitalize on investor interest. The company’s focus on an asset-light expansion model, coupled with rising demand for mid-market hotels in India, makes it a promising candidate for long-term growth.

As the IPO unfolds, market watchers will keep a close eye on subscription levels, investor mix, and post-listing performance to gauge whether Suba Hotels can replicate this anchor success on a broader scale.